For many aspiring entrepreneurs, the dream of owning a franchise or starting a business can be both exciting and daunting, especially regarding financing. Money is both a barrier and a motivator for starting a business. While some may be able to fund a low-cost franchise through personal savings, others often find themselves seeking external franchise financing options. The good news is that many funding avenues are available for those eager to invest in a franchise.

Before exploring the various franchise loans, grants, and financing opportunities available, let’s first explore the terms, costs, and requirements of initiating your franchise financing journey.

Understanding Franchise Financing Costs and Fees

Owning a franchise comes with a mix of one-time and recurring expenses. Buying a franchise business requires an initial investment, of course. If potential buyers don’t have the cash to cover the initial franchise licensing and other startup costs, they must apply for a loan from the franchisor or another lender. After the initial investment, it’s also important to consider ongoing fees. The bulk of these costs and fees must be outlined in the Franchise Disclosure Document (FDD). The FDD provides prospective franchise buyers with the requirements and obligations they can expect from a business relationship with the franchisor. The FDD is not only considered an essential part of the franchise evaluation process. The franchisor must legally provide it to a franchisee candidate at least 14 days before signing an agreement or exchanging any money. Here are some of the common costs and fees you can expect to incur.

- Startup Costs: Startup costs can vary greatly from franchise to franchise. Generally, franchise startup costs are the initial investment costs and expenses you’ll incur to launch your new business.

- Franchise Fees: Most franchises charge an initial franchise fee, which varies depending on the brand. This fee, payable either upfront or in installments, covers essential startup expenses like training, website setup, and initial supervision. While some franchises offer flexible fee payment schedules, others maintain a fixed structure. If you’re uncertain about fee arrangements, consulting a franchise lawyer can provide clarity.

- Franchise Royalties: Royalties are ongoing fees, often calculated as a percentage of gross revenue, payable weekly or monthly. However, certain franchises, like TSS Photography, may waive royalty fees altogether.

- Advertising & Marketing Fees: In exchange for brand recognition and marketing support, franchisees are typically required to contribute to monthly marketing and advertising fees, usually as a percentage of revenue.

In addition to these standard fees, the FDD will outline a range of other potential expenses, including those related to operational expenses, bank fees, permits, and more.

Creating a Franchise Financing Checklist

Franchise investments span a wide financial spectrum, with opportunities available in various industries and price ranges. While some industries offer affordable entry points, others require substantial capital upfront. Initial research into franchise opportunities provides general investment ranges, while a deeper dive into individual FDDs will offer more precise information tailored to specific brands and industries. However, remember that regional market dynamics must be considered when assessing projected costs and revenues. The FDD can help you fill in the blanks for many of these essential considerations. It provides the data and insights you need to understand your obligations, including the initial and ongoing financial commitments and potential performance metrics.

Understanding and outlining the following key franchise financing elements is crucial before acquiring funding and committing to a franchise investment.

- Total estimated startup costs

- Financing options for initial expenses

- Repayment plans for loans

- Revenue generation strategies and key business activities

- Timeframe for achieving positive cash flow

- Ongoing operational expenses and fees

- Contingency plans for unforeseen financial challenges

- Long-term business valuation prospects

- Anticipated capital requirements over time

- Alignment of financial expectations with franchisee experiences

- Overall return on investment assessment

Managing Franchise Financing Options

Once you’ve assessed your financial needs and obligations, it’s time to explore funding avenues. Franchisors often assist new franchisees, offering waived fees, loan options, or deferred payment arrangements. Additionally, governmental institutions like the Small Business Administration (SBA) offer loan guarantees, streamlining the financing process for approved franchises. Other financing options include leveraging retirement accounts through programs like Rollovers for Business Start-Ups (ROBS), portfolio loans backed by securities, or unsecured loans from banks, credit unions, or third-party lenders.

Regardless of the franchise financing source, a robust application typically requires documentation verifying credit history, personal financial statements, and a comprehensive business plan outlining investment utilization and revenue projections. Consulting with franchise attorneys and financial advisors specializing in franchise funding can offer invaluable guidance throughout the process.

Finding Your Ideal Franchise Fit

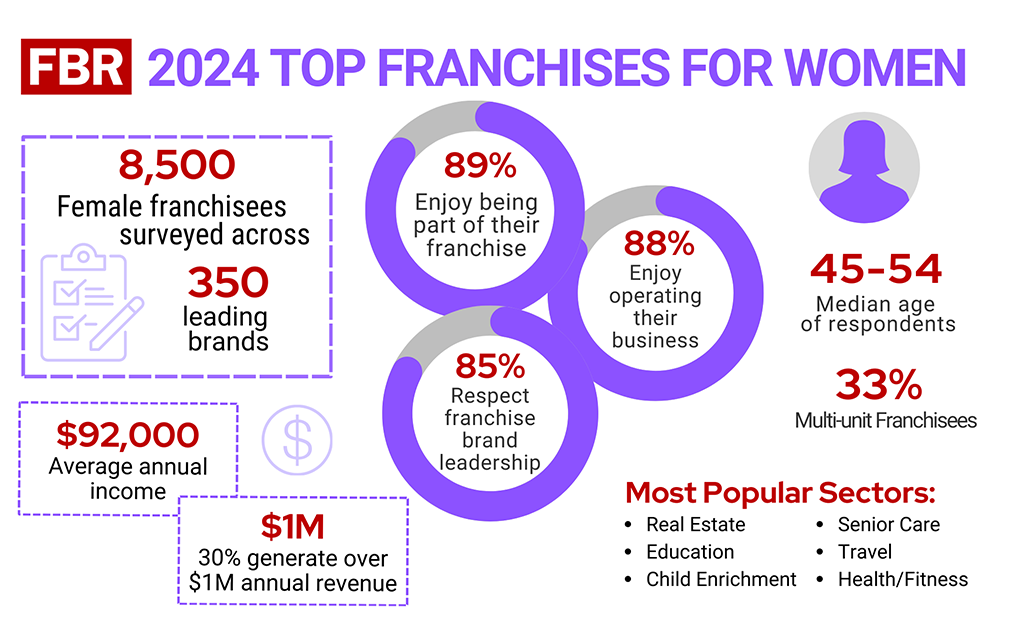

With the financial groundwork laid, it’s time to explore top franchise opportunities aligning with your budget and aspirations. Franchise Business Review provides comprehensive resources and ratings to aid in this search, ensuring prospective franchisees find the best-suited opportunities.

Whether you’re eyeing a low-cost venture or aiming for a high-end investment, careful financial planning and strategic funding choices pave the way for a successful franchise journey.

Related Content:

Unlocking Your Potential: Elevating Dreams Through Franchise Financing

Fast Financing Options: Portfolio Loans and Low-Doc SBA Loans

Should I Use a 401K Rollover to Finance My Business Startup?

Should I Use an Unsecured Business Loan to Finance My Franchise?

Should I Use a Crowdfunding Platform for My Business Startup?